Introduction

Since 2021, there has been increasing investor interest in Professional Services (Audit, Tax, and Advisory) firms. Investors recognize the industry as a good investment, as it has stable revenue streams, high quality professionals who are trusted advisors to their clients, potential for growth through consolidation, and opportunities for technological and service innovation. In 2024, the pace of investments has dramatically accelerated, with more investors entering the market, and a surge in merger and acquisition (M&A) activity driven by strategic acquirers, seeking to grow revenues, and expand their geographic footprint and/or service offerings.

These investments are taking place amidst significant market disruption caused by evolving customer needs and the increasing adoption of advanced technologies, particularly Generative AI (Gen AI), which is transforming how services are delivered. Previous AI solutions focused on automating repetitive tasks, but Gen AI is expected to automate higher-level knowledge work.(1) The use of Gen AI at Professional Services firms will impact what services to offer (services & products), who will deliver those services (people), how the services will be delivered (business operations), and how much to charge for those services (pricing).

All Accounting firms, irrespective of size have recognized that doing nothing is not an option. To maintain and increase revenue growth, they face pressures to leverage technology to enable their professionals to be more effective and efficient, become industry and product specialists, and create productized offerings and services to generate recurring revenues. The actions that each firm takes will be determined by their current market position, and views of firm leadership.

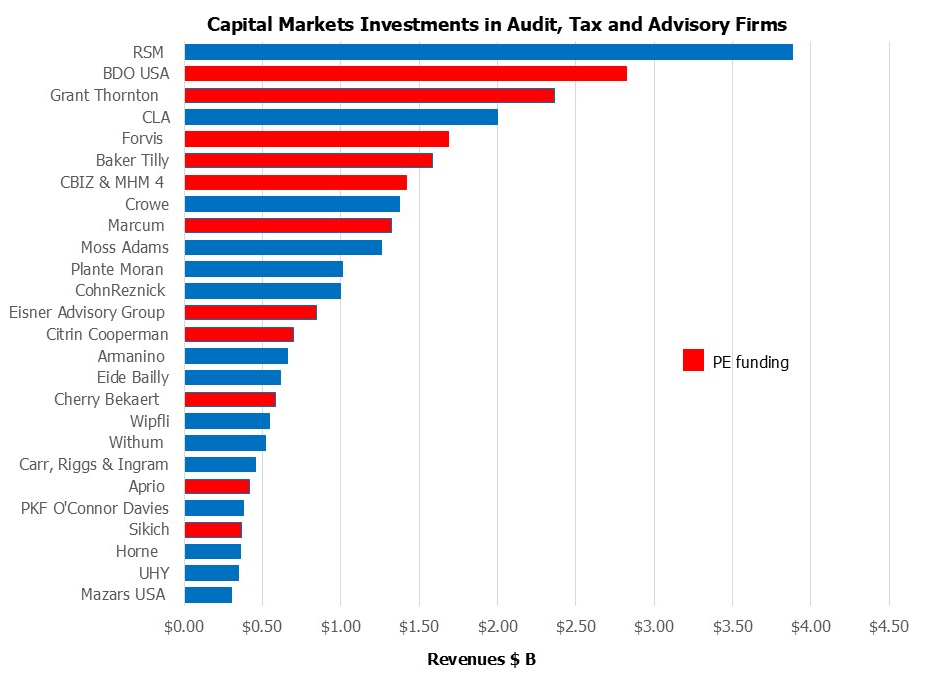

Types of Funding for Audit, Tax and Advisory Services

To date, the 5th to 30th ranked firms have seen the most amount of investor interest. Combined this group generated $28.8B in revenues in 2023, which is ~20% of the $147.5B market (5). Some of the investments include (6):

- PE funding – The firms that got early PE investments (in 2021 & 2022), i.e. Eisner Amper, Citrin Cooperman and Cherry Bekaert, more than doubled in revenues in the past 12 to 18 months, through multiple strategic acquisitions. Their success has resulted in other investors rushing in to provide funding to Audit, Tax and Advisory firms to generate high returns. From the beginning of 2024 to date, Grant Thornton (03/2024), Baker Tilly (02/2024), & Aprio (09/2024) all received funding. As we head into the fourth quarter of 2024, a few more deals are likely to be announced before the end of the year.

- Public Company – CBIZ (a public company) and Marcum agreed to merge (07/2024).

- ESOP – BDO established an ESOP (Employee Stock Ownership Plan) (08/2023).

- Private Capital – Sikich sold a minority stake to a private capital firm (05/2024).

- Merger of Equals – Forvis combined with Mazers (06/2024).

Impact of Investor Funding on Audit, Tax and Advisory Firms

Even with investor activity picking up considerably, we are already seeing some signs of concern within the industry about the impact of getting outside funding on talent, growth, and quality of client delivery and services. In a recent pulse survey by Inside Public Accounting, firm partners’ response to PE funding going into Audit, Tax and Advisory firms was mixed, with only one-fifth of the participants believing it to be positive. Some concerns were around the negative impact on culture, legacy, headcount cuts, and overvaluation of assets. Most professionals agreed that PE investment was going to increase the pace of change in an already rapidly changing profession. (2)

Some of the challenges faced by firms receiving early investor funding were:

- Vialto, the global tax and immigration consultancy that used to be part of PwC, and was sold to Clayton Dubilier in 2022, has struggled to meet its financial targets, saw a deterioration of its liquidity profile, faced operational challenges, and had to replace its CEO. (3)

- Cherry Bekaert got funding from Parthenon Capital in 2022, recently laid off several senior leaders from its Advisory practice, along with employees in audit, advisory, and non-core tax, in a bid to counter economic difficulties, shifting market dynamics and to ensure long-term stability. Alongside the layoffs, the firm also implemented salary reductions for partners and professionals. As a result, the firm’s workforce has experienced decreased morale and increased stress, impacting overall business strategy and operations. (4)

- Eisner Amper, who got funding from Towerbrook Capital in 2021, had employees share negative feedback online on the firm operations, citing overwork, scheduling challenges, offshoring of tasks resulting in deteriorating service quality and timeliness of delivery, combined with high levels of stress and lower morale. (4)

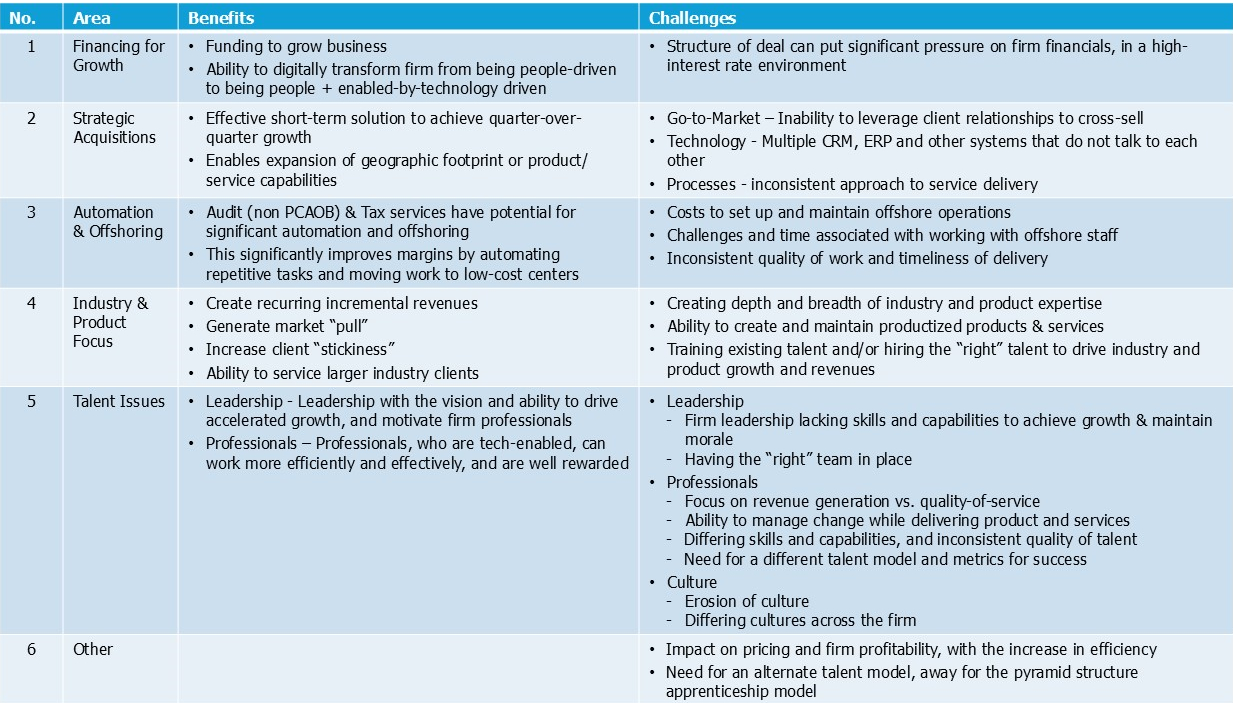

The Benefits and Challenges of Investor Funding

While investor funding offers significant benefits, including access to capital for expansion and technological innovation, it also presents unique challenges for the industry. Some of the benefits and challenges of receiving funding are:

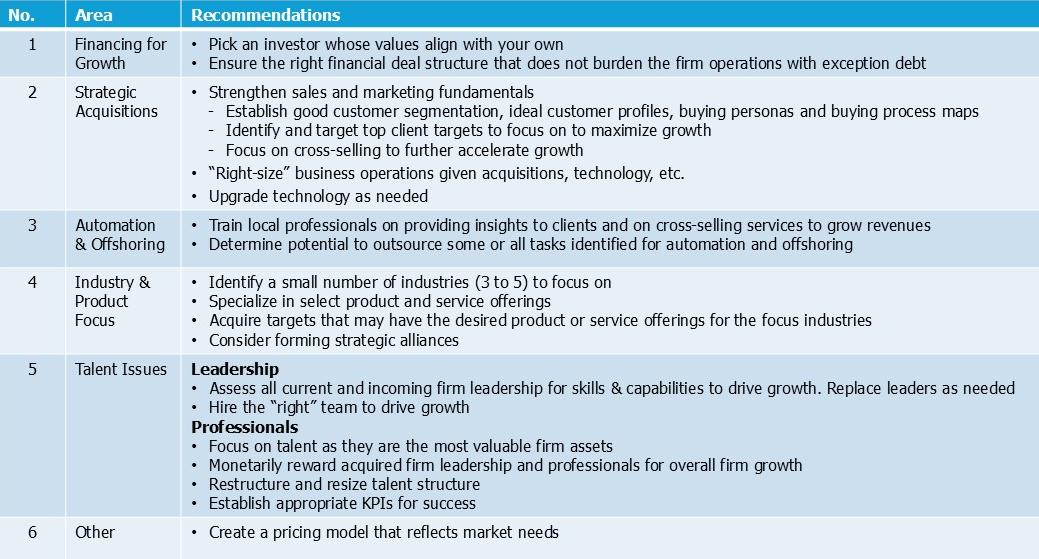

Insights from Investors and Leaders to Address Growth Challenges

We spoke with PE founders, strategic acquirers and firm leadership of PE-funded companies to get their insights on addressing growth challenges, including Xena Ugrinsky, co-founder Pilot Wave Holdings, Daniel Perry, Resource Partner, Sales Excellence, Court Square Capital Partners, and Craig Brink, former Founder and CEO of RatPac Controls.

According to Daniel, “’Professional Services companies need to realize when they get major investment from a Private Equity firm, they are now beholden to the PEs goals. Remember, PE is there to give returns for its Limited Partners. Period. The PE firm is going to do the things necessary to accelerate revenue growth and EBITDA. Those goals might not have been in alignment previously.”

Based on his experience, Craig suggested “pick a partner whose values align with yours. Ask the investors how the other companies in their portfolio are doing.” This discussion will play a critical role in the success of the firm. Once you pick the investor “ensure that you have the right team in place to achieve the desired revenue and growth objectives.”

According to Xena, “while organizations have been undertaking transformation efforts for decades, the expected ROI is rarely achieved. This is often due to organizations overestimating the change management skills they have in-house, and a reticence to bring in outside resources to augment their own”. To outmaneuver the competition in what is shaping up to be a race to progress, Xena recommends accelerating internal change management by approaching skills gaps strategically, and in the right sequence.

Finally, according to Daniel, “Most professional services firms are weak on sales and marketing fundamentals. I have helped many PS firms establish the basics of good customer segmentation, ideal customer profiles, buying personas and buying process maps. They don’t have these fundamentals because they were not asked to grow significantly over a short period of time. Without these fundamentals, you cannot sustain the growth and scale.”

To summarize, some of the recommendation to address challenges include:

Actions for Investor-funded Firms to Take to Accelerate Returns

The time to act is now. Any path to growth would require Investor-funded Professional Services firms to take market share away from other players. Once first-movers lock in clients in the relevant market segment and industry, getting them to move will be much harder. Industry and product specialization will be a critical factor in achieving consistent market growth. Additionally, leadership should recognize that technology, such as AI and Generative AI, have the potential to be the game changer and should leverage it to create new revenue streams. In addition to generating new revenue streams, AI can also transform traditional accounting businesses into data businesses and increase the EBITDA multiples for future transactions. To successfully execute a growth strategy requires deep skills and expertise. We recommend a two-step process to execute on this approach:

- Bring in Subject Matter Experts – Firms may need to acknowledge that their in-house capabilities may not be sufficient to achieve consistent, rapid growth. External experts specializing in business strategy, sales, AI, and data science can be instrumental in revising go-to-market strategies and creating new revenue streams.

- Adopt a Systematic Approach to Revenue Growth – No “one-size-fits-all” solution exists for driving firm growth. A more holistic, systematic approach is required:

- Conduct External Market Analysis: Understand the shifts in customer needs, competitive dynamics, regulatory environments, and emerging technologies. Focus on identifying “unmet needs” and devising ways to address them.

- Perform an Internal Business Review: Assess all aspects of the business, including priority client and industry focus, service offerings, processes, technology, and talent. A top-down and bottom-up revenue analysis can ensure the firm meets its growth targets while revising the business model to suit future needs. Create a business growth strategy and roadmap with prioritization and sequence of activities of drive growth.

- Execute the Growth Strategy: Once a roadmap is created, focus on execution, adapting as market conditions change. Traditional metrics like utilization and revenue targets may need revision, and new pricing models (e.g., time and materials, flat fee, or a hybrid approach) should be considered.

Conclusion

With many Audit, Tax, and Advisory firms securing PE funding to fuel expansion and capture market share, the firms that move quickly and strategically stand to reap the most significant rewards. Some key steps to take are:

- Time is of the essence. In today’s dynamic market environment, speed is essential for success.

- Play to your strengths. Bring in the right subject matter experts to enhance capabilities in business strategy, AI, and data science.

- Execute with precision. Focus on market needs and adapt strategies as the competitive landscape evolves.

- Stay ahead of the competition. Continuously refine your go-to-market strategy, pricing models, and performance metrics to capture value in a rapidly shifting industry.

The path to success in the Audit, Tax, and Advisory space isn’t one-size-fits-all, but with the right approach, your firm can be positioned for substantial growth. Don’t wait—take the first step today to secure your place as a leader in the future of professional services.

Source:

- Tech Trends, 2024, Deloitte, January 2024

- Concerns Abound Over PE Impact, But Firm Leaders Believe They Can Compete, Inside Public Accounting, July 10, 2024

- PwC spin-off to restructure $1.5bn in debt after cost overruns, Financial Times, September 13, 2024

- Cherry Bekaert Layoffs: Know Full Insights & Impact, August 2024

- https://www.reddit.com/r/Accounting/comments/1bcd5s3/eisneramper_was_the_first_large_accounting_firm/?rdt=38741

- Statistica, https://www.statista.com/topics/2121/accounting-industry-in-the-us/

- From Mother Ships Deals to ESOPS, by Chris Camara, Inside Public Accounting, September 2024

- Accelerating the Pace of Returns from your Portfolio companies leveraging AI, January 2024

- How AI is Disrupting Professional Services (Audit, Tax and Advisory firms) and what we can do about it, January 2024.

- Transformation of Professional Services – The Audit, Tax and Advisory “Firm of the Future,” April 2024.

Tag/s:Business TransformationDigital Enterprise

Great article with key insights and a call to action. Firms considering PE engagement will be wise to follow Nita’s advice.